Eglin Federal Credit Union has teamed up with the Okaloosa County School District to provide financial literacy education to high school students. The initiative aims to empower young people with essential financial skills and knowledge.

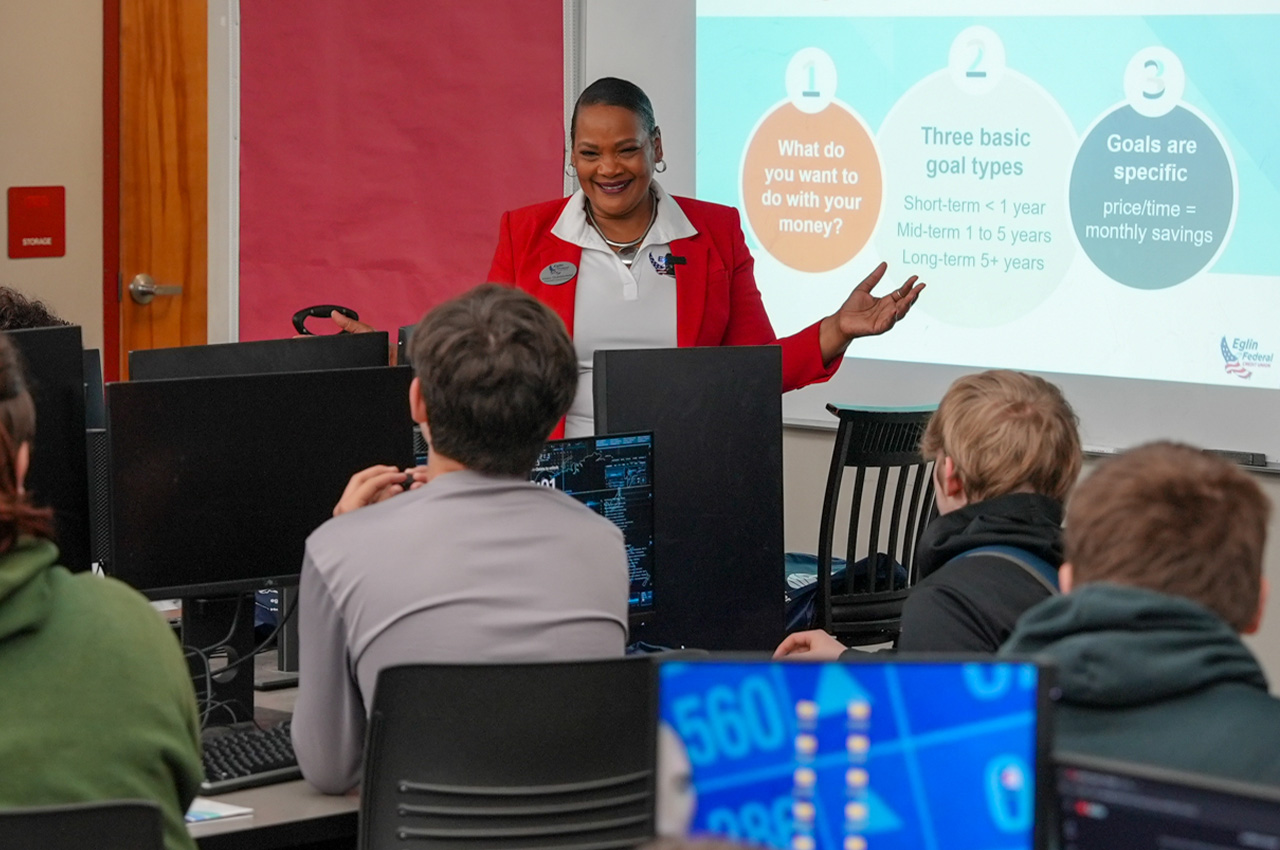

On April 9, approximately 60 students from grades 9 through 12 participated in lessons facilitated by Neko Stubblefield, VP Membership and Community Development at Eglin Federal Credit Union, at Crestview High School.

- The personal financial literacy course covers a wide range of topics, from basic banking to retirement planning.

“Eglin Federal Credit Union is committed to the communities we serve by providing free financial education,” Stubblefield said. “By offering this course in local high schools, we aim to empower young people to develop healthy financial habits that will serve them throughout their lives.”

Superintendent Marcus Chambers emphasized the school district’s dedication to enriching students’ education and equipping them with essential life skills, including financial literacy.

- “The school district is grateful for the support of Eglin Federal Credit Union in facilitating financial education sessions to supplement the course curriculum, which will help students develop sound financial habits and achieve economic prosperity,” Chambers said.

The initiative comes in response to the Dorothy L. Hukill Financial Literacy Act, signed by Governor Ron DeSantis on March 22, 2022. The act mandates that high school students complete a financial literacy course to qualify for a standard high school diploma, starting with students who enrolled in high school in the 2023-2024 school year.