On Friday, May 3, 2023, Fort Walton Beach High School and the Okaloosa Public Schools Foundation hosted the second annual ‘Reality Check’, a financial education program aimed at teaching high school students about financial literacy, fiscal responsibility, and budgeting for the real world.

- The event was made possible by a grant from Wells Fargo and was held in the new multi-purpose building at the high school.

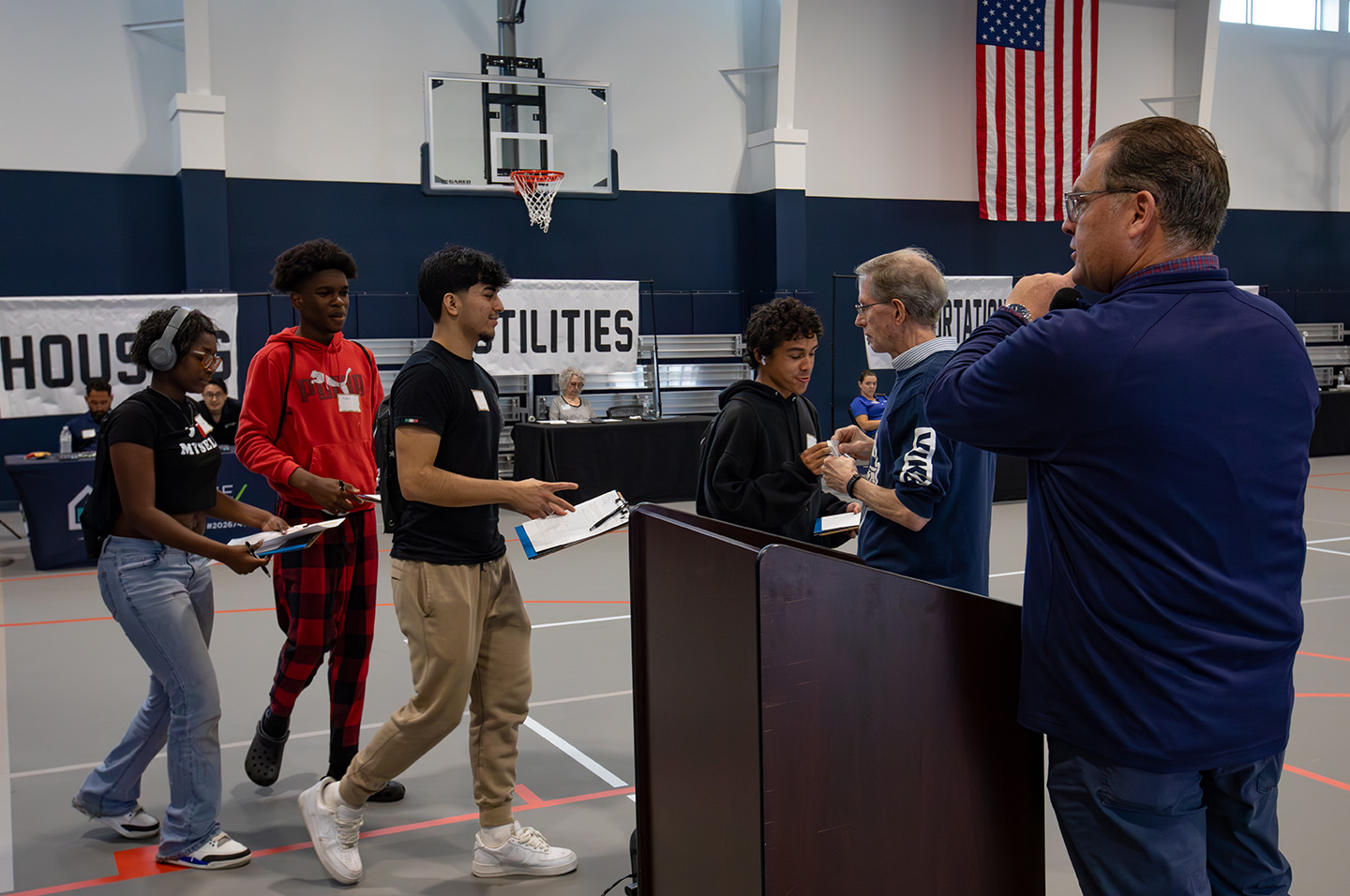

Throughout the morning, students from 9th to 12th grades participated in an activity where they were randomly assigned occupations, salaries, and credit scores.

- The event provided students with a glimpse into real-life financial decision-making as they visited booths staffed by community partners and volunteers from various industries, including insurance agencies, mortgage lending, auto lending, finance, retail, and communications.

According to John Spolski, Assistant Superintendent of Okaloosa County School District, the students were well-prepared for the event.

“These particular students are in Financial Literacy Honors. Some of our different high schools offer this course, and I really feel like Mr. Bill Knox, the instructor here at Fort Walton Beach High School, really had them in a strong position to engage,” he said.

Spolski also emphasized the importance of having real-world professionals at the event. “These are not actors. They’re not portraying these industries. These are real employers, part of large organizations,” he added.

Mr. Bill Knox, a teacher at Fort Walton Beach High School, explained how the event tied in with the Personal Financial Literacy Honors course.

- “In class, we’re taking personal finance a chapter at a time,” he said. “Even though we’re not done yet with the semester, coming in here to Reality Check, they get to see how it really works out there in the real world.”

As students navigated through the various booths, they were faced with unexpected challenges and life events designed to simulate the unpredictable nature of real-world financial situations. Throughout the event, students were randomly assigned additional details that impacted their financial decision-making process.

Some students were informed that they were married or had children, which required them to factor in the costs associated with supporting a family. Others were told they had experienced a flat tire, emphasizing the importance of having an emergency fund to cover unexpected expenses.

- Mr. Knox explained, “There’s a chance table, like in Monopoly, so you go through and they pull out a number, they match it up, they either get something, or you had a flat tire, or those kinds of things, purely by chance.”

These “hiccups” were intentionally incorporated into the ‘Reality Check’ program to demonstrate that life doesn’t always go as planned and that adjustments need to be made accordingly. By facing these simulated challenges, students learned the importance of adaptability and the need to prioritize expenses based on changing circumstances.

“If they have a negative balance, then they can go to financial counseling, or they can go back to the bank and get a loan, which is another expense,” Mr. Knox added, emphasizing the learning opportunities presented by these financial obstacles.

Ed Burns, Community President at United Fidelity Bank, shared his perspective on the importance of the event.

- “It is truly about as real-world as you can get,” he said. “Being able to allow high school students to have this experience is incredibly important. Students are already seeing that maybe they shouldn’t spend $200 on concert tickets if they don’t have a car yet. Or, they realize they are in the clothing booth and don’t yet have a house.”