Okaloosa County is moving forward with the countywide expansion of the Bed-Tax District. The election will be a mail-in ballot only election, with ballots hitting mailboxes this week.

Currently, 62 of the 67 counties in the State of Florida have a bed-tax.

- This bed-tax can be anywhere between 2% – 6% of overnight hotel stays when people are staying at hotels, vacation rentals, condos, and even campgrounds.

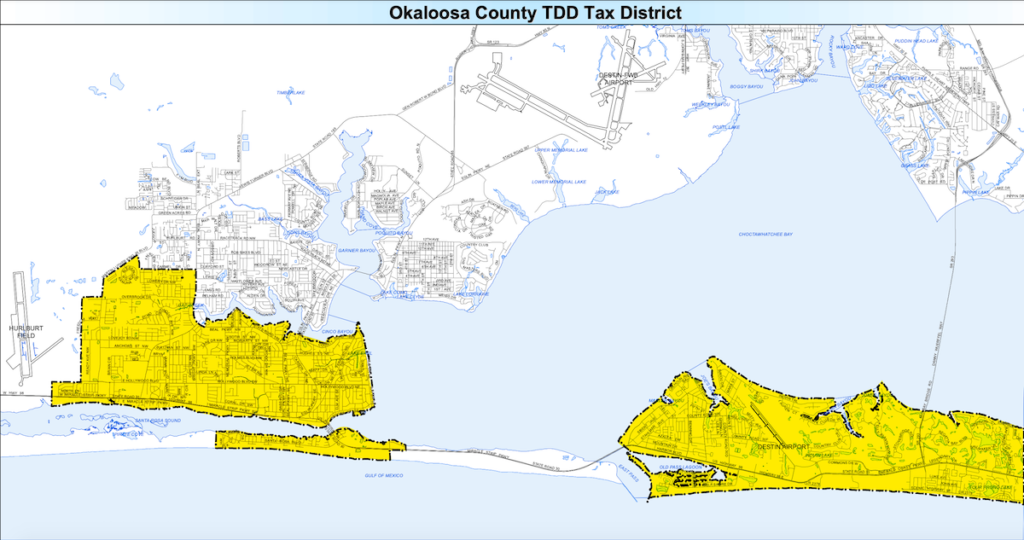

- Okaloosa County only levies the bed-tax on the south end of the county.

- You only pay the tax if you have an overnight stay.

According to Okaloosa County, 58 counties in the State of Florida levy a bed-tax countywide.

“We’re one of the few counties who only have it in a certain portion of the county,” said April Sarver, Public Information Officer for Okaloosa. “The County Commissioners approved a mail-in ballot for the citizens of Okaloosa County, so that they can decide if that tax should be levied countywide instead of just in the south end.”

There are certain things that the revenue collected from the bed-tax can pay for, and it can only pay for things that are in the area it’s been collected from.

- For example, since the bed-tax district is not countywide, tax dollars collected in Fort Walton Beach cannot be used to improve one of the parks in Niceville.

“One major thing to remember is the fact that these funds can only be used in the Destin & South Fort Walton Beach area,” explained Sarver. “Our entire county does have tourism. We have tourists that come through Niceville, they come through Crestview, to get to the south-end of the county. There are even opportunities in Crestview for eco-tourism that can be expanded with bed-tax dollars.”

For the Tourist Development Department, expanding the district would mean expanding the promotion of tourism to not be all about the beaches. The plan would be to expand the promotion to more of a year-round destination.

“We’ve heard the concerns about more traffic, and nobody wants more traffic on the roads, but with tourism management, that tourism can be spread out year-round and in other destinations than just on Highway 98,” continued Sarver.

What is the bed-tax revenue allowed to pay for?

The basic answer is: Anything that is related to tourism.

“Say there’s a boat ramp in the north-end of the county that tourists could potentially use to do some eco-tourism. That boat ramp could be improved with bed-tax dollars,” said Sarver. “The parks can be improved, our waterways conservation efforts, along with public safety can all be improved and funded with these bed-tax dollars.”

Okaloosa County Public Information Office

Okaloosa County Public Information OfficeWhat do know about participating in the election.

Residents outside of the current taxing district can expect ballots to arrive in mailboxes after September 15th.

- Crestview

- Baker

- Laurel Hill

- Niceville

- Shalimar

- Parts of Fort Walton Beach

The ballot has to be returned to the Supervisor of Elections by October 5th.

- Ballots can be returned via mail, or delivered in-person.

- There are instructions on the ballot when you receive it in the mail.

“It’s important to understand what you’re voting on,” said Sarver. “This is a way to increase the revenue that can be used for infrastructure, not necessarily new roads in neighborhoods, but for facilities, parks, maintenance, and capital improvements.”

For more info on the upcoming election, head to MyOkaloosa.com.