The Okaloosa Public Schools Foundation and Eglin Federal Credit Union have collaborated to introduce a financial education program, Reality Check, to Okaloosa County for the first time.

- The program was aimed at educating high school students from the 9th to 12th grades on financial literacy, fiscal responsibility and budgeting in preparation for the real world.

Approximately 60 students from Laurel Hill School took part in lessons facilitated by EFCU Financial Education Specialist, Courtney Dollson, on April 12 and 19. The final Reality Check simulation was held at the Crestview Community Center on April 26, where students participated in an activity where they randomly received various occupations, salaries, and credit scores.

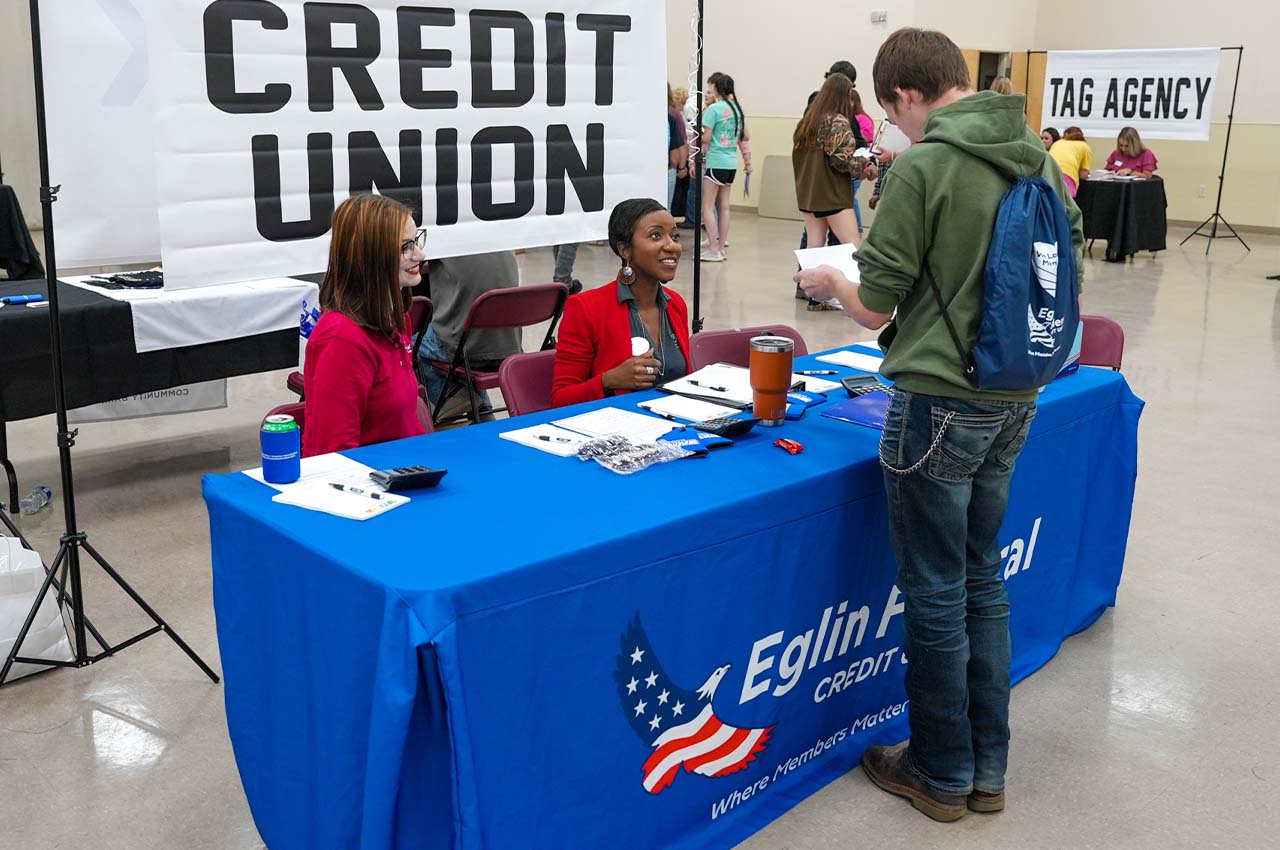

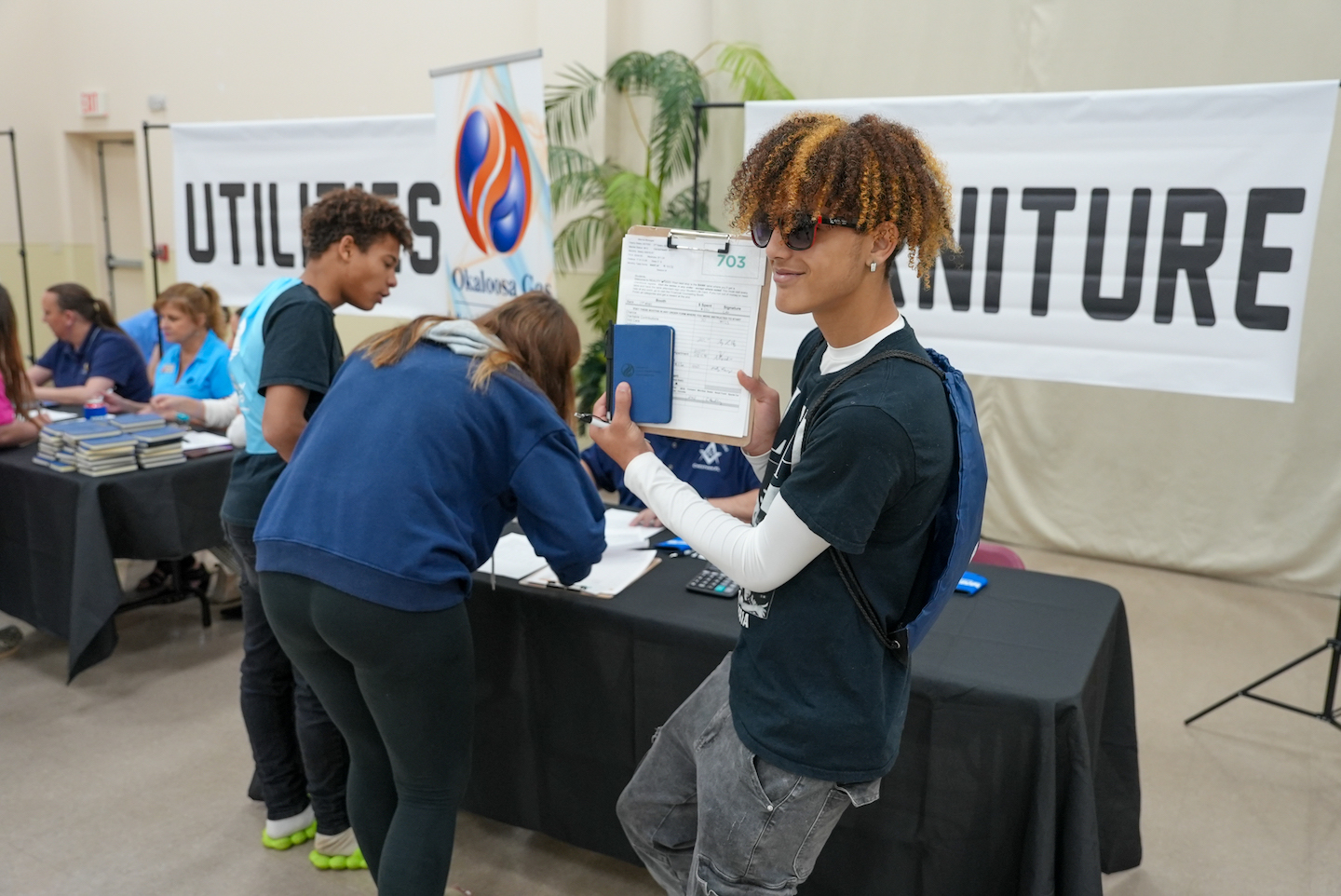

The event was aimed at providing students with a glimpse into real-life financial decision-making, where they visited booths staffed by community partners and volunteers from insurance agencies, mortgage lending, auto lending, finance, retail, and communications.

- They made purchases based on their salaries and credit scores, and their expenses were calculated to help them understand how to budget their finances effectively.

During the event, students were offered breakfast and lunch provided by a grant from the Okaloosa Public Schools Foundation.

“Financial literacy and fiscal responsibility are life skills,” said Executive Director Okaloosa Public Schools Foundation Steve Horton. “The Okaloosa Public Schools Foundation is grateful to be able to partner with Eglin Federal Credit Union and our other volunteers to host this event for our students. We are committed to enhancing students’ education, and this Reality Check event provides a perfect forum to do just that.”

According to EFCU Financial Education Specialist Courtney Dollson, “Eglin Federal Credit Union is committed to the communities we serve by providing free financial education. We hope to continue this event annually and see even more growth in the coming years.”

The program was successful in its aim to provide high school students with a practical understanding of financial decision-making. Amy Senterfitt, one of the participating students, stated that “today I really learned how to budget my money and how the real world is actually going to be.”