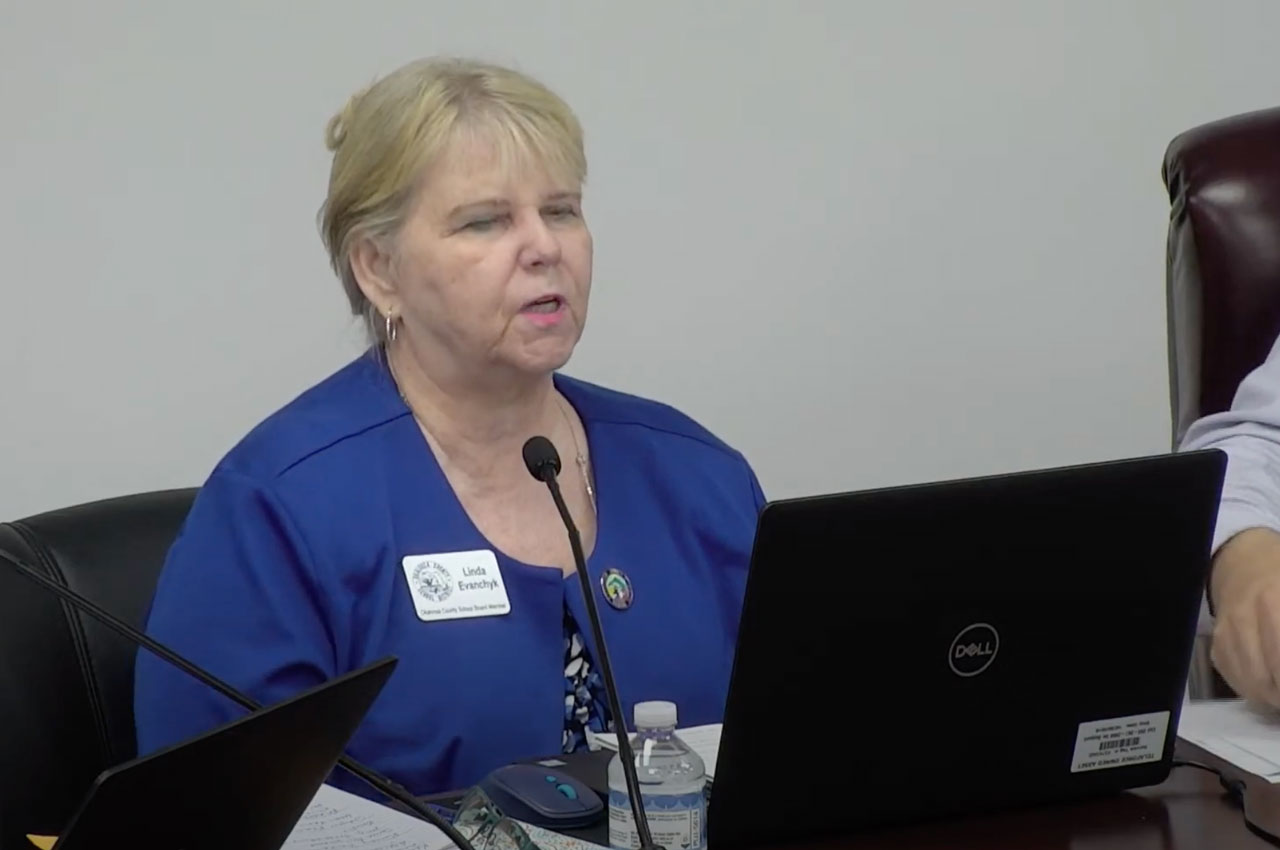

During the recent Okaloosa County Election Candidate Forum on July 7th, the challenger for the School Board District 3 seat, Darrel Barnhill, made a claim at the very end of the forum that incumbent Linda Evanchyk voted to raise taxes at every opportunity.

The statement came in response to a conversation that Barnhill said he had with one of his supporters who asked why he was voting to raise taxes further.

- “That’s not my vote,” Barnhill said, “but my opponent has voted to raise taxes every year she’s been there.”

Although Evanchyk wanted to counter her opponent’s claim, she was not allowed to do so due to the forum running out of time. To set the matter straight, Evanchyk agreed to an interview to clear up any lingering confusion:

“What I believe Mr. Barnhill is speaking to has to do with the formula the state uses and how we ultimately come up with our millage,” said Evanchyk.

She says that there are three categories used in the formula:

- Required Local Effort

- Discretionary Basic Funding

- Capital Outlay

According to the Florida Education Finance Program Fact Sheet, required local effort is the amount of funds the district receives from levying the state certified local effort millage rates on the district’s ad valorem property. It states:

- All districts levy the same millage, which raises more or less dollars per student depending on the value of the local property. The percent provided from local sources ranges from 10%to 90% of the total.

- The amount of required local effort that each district must provide to participate in the FEFP is subtracted from the total State & Local FEFP Dollars to determine state FEFP dollars.

- If a district has low property values, then the state funding, as a result of this subtraction, is greater. The converse is true if a district has high property values.

“Technically, the school board could do what’s called a rollback on part of that money. I know he [Barnhill] knows this because he was a board member of Walton County,” Evanchyk said. “When you do that, essentially the state penalizes you, they give you less. They’re not going to match the funding, so why would we do that when our millage rate is the lowest it’s been in 31 years?”

Currently, the millage rate is at 5.943 compared to a decade ago when the rate was over seven. Two decades ago, it was over eight.

“That is what I believe he’s talking about,” Evanchyk said, “We’ve never had it come up where we were trying to raise, for example, the property tax or the millage or anything. Every time our board approves our budget, we do it based on these categories, based on that millage and everything.”

Evanchyk says that when this happens, it is publicly noticed in the newspaper that the board is “officially raising taxes” but it is because they are not rolling it back.

“That’s what I’m assuming he’s referring to because he’s never really explained it, but that would be the only way,” added Evanchyk. “The only actual tax I’ve voted for was to put the half-cent sales tax on the referendum that voters approved.”