Last Wednesday, the Florida Legislature passed three bills, one of which is aimed at stabilizing the property insurance market in Florida.

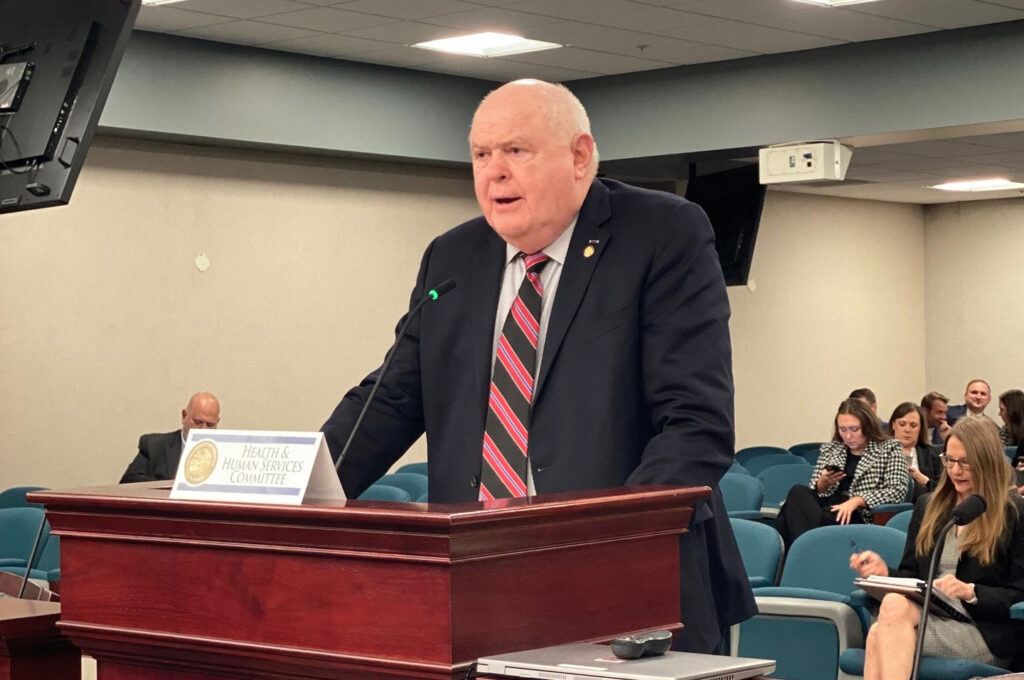

- Senate Bill 2A is designed to improve the property insurance marketplace for homeowners, according to State Representative Patt Maney, and is the most significant property insurance reform bill in recent history.

“Over the last 18 months, Florida has witnessed multiple insurance carriers fail or decide to stop doing business in our state,” wrote Maney in an email. “There are a multitude of reasons why, but three major reasons include the increase in Florida property values, litigation costs, and the cost of reinsurance for insurance companies.”

Maney says that because of the current demand for housing in Florida, prices are up, which inevitably leads to increased insurance rates.

“In recent years, Florida has accounted for over 75% of insurance litigation in the nation,” he added. “Florida sees around 100,000 of these lawsuits each year, compared to ~1,000 in every other state.”

- Reinsurance costs (insurance for the insurance companies) rose 28% in 2021 and 52% in 2022.

Maney says that these are three main drivers of rising property insurance costs, with the latter two having caused insurance companies in Florida to lose money to the tune of billions of dollars.

Local news sent to your inbox 🤝

Thousands of locals read our newsletter every morning! It’s FREE and makes sure that you never miss important local updates.

According to the Governor’s Office, SB 2A will strengthen Florida’s property insurance market by:

- Eliminating one-way attorney fees for property insurance claims, which will disincentivize frivolous lawsuits, and realigning Florida’s market to best practices that will promote more market competition in the private insurance industry.

- Reducing the burden of excessive and predatory litigation will help bring down costs for homeowners.

- Enhancing the Office of Insurance Regulation’s ability to complete market conduct examinations of property insurers following a hurricane to hold insurance companies accountable and prevent abuse of the property appraisal process.

- Reducing timelines for insurers to get payments out the door and back into the hands of policyholders as they rebuild their lives.

- Building on reforms passed earlier this year by committing additional funding to provide temporary reinsurance support to help stabilize our market.

“Consumers need relief from the jumps in property insurance prices,” added Maney. “We also know there can be bad actors and some Floridians have seen their livelihoods hang in the balance because of those bad actors. Florida can’t have a property insurance market if there are no companies willing to insure our property.”